There’s no getting away from it.

If you want to make your subscription-based business truly successful you need to build strong relationships with your customers.

This doesn't mean simply contacting them during a sale or a contract renewal. It means maintaining consistent, meaningful communication that brings value to your customers both now and in the future.

As with any long-term business process, it’s critical that you regularly measure what you’re doing to make sure you're improving over time. Managing your customer relationships is no exception to this rule, which is why we’re covering customer-focused metrics in this article.

There’s a host of different metrics we could look at – everything from TTV (Time to Value) through to your customer churn and retention rate – but today we’re going to concentrate on three:

- Customer Health Score

- Average Lifetime Value

- Net Promoter Score

These 3 customer success metrics are a great indicator of your overall relationship with each of your customers - and may help to predict future churn/retention.

Unfortunately, not all businesses pay attention to them.

In fact, most businesses don’t fully understand who should own them.

Who should be measuring customer-focused metrics?

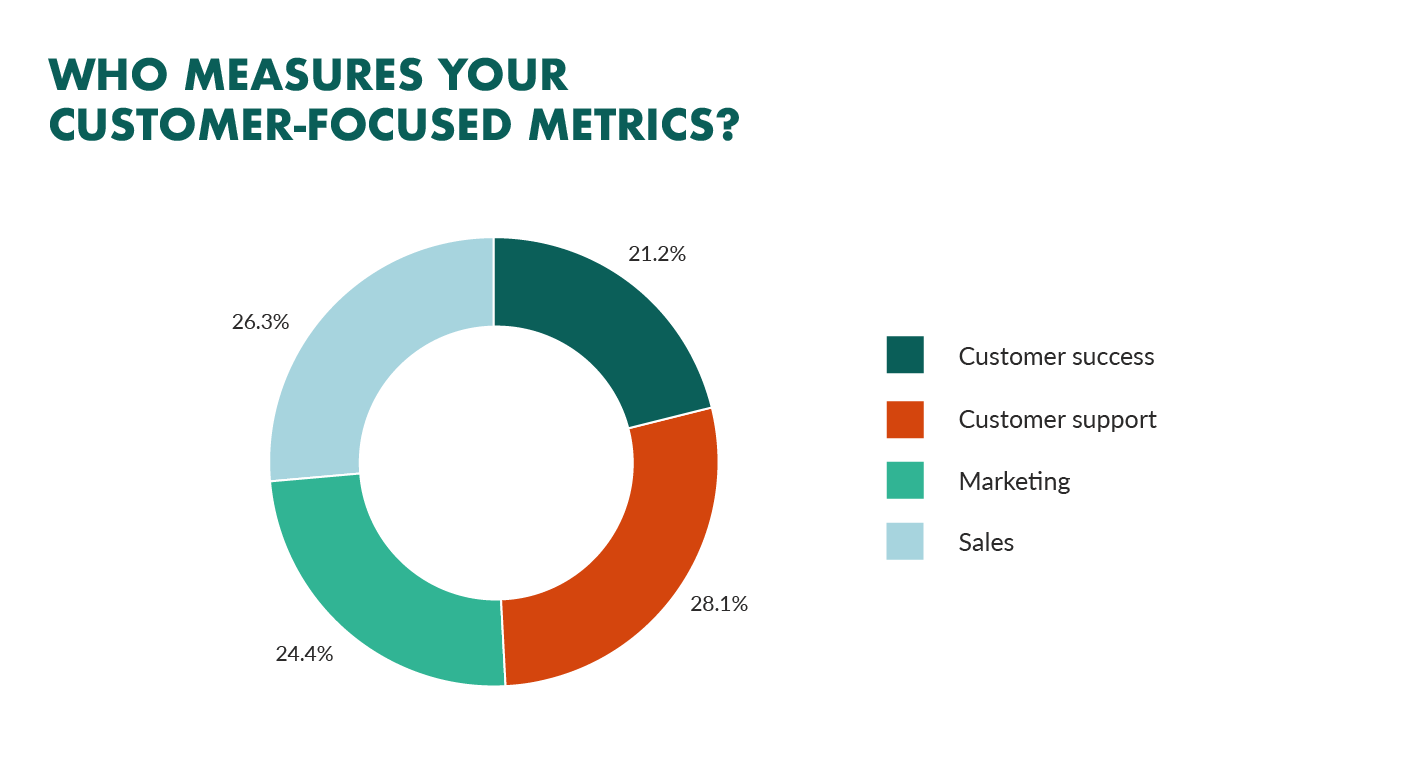

Earlier this year, we asked 547 companies “Who is responsible for customer success?”.

Surprisingly, there was no clear winner.

Worse still, the Customer Success department came in last (how does that work?)!

With a near equal split across customer success and customer support, sales, and marketing, the conclusion we can draw from this is that even if a business does track customer success, they’re still not sure who should own it.

And that’s OK…

…because the three metrics we’re focusing on today – Customer Health Score (CHS), Customer Lifetime Value (CLV), and Net Promoter Score (NPS) apply to every business – whether you have a customer success team or not.

1. Customer Health Score

According to our research, we found that only 7% of companies actively track their Customers Health Score, and more than 50% had never even heard of it!

![]()

So, with that in mind, let’s explore what CHS is all about.

Nurturing, negotiating, closing a deal – all of this takes time, but once it’s done, that’s when the relationship really begins.

As with any long-term relationship, you’re going to have to work really hard to make it successful.

Of course, business relationships differ slightly, so it’s not like you can send them a WhatsApp message full of emojis to see how they’re doing 💁👌🎍😍…

That’s where Customer Health Score comes in. It’s a way to measure how happy, healthy and functional the relationship with each of your customers is.

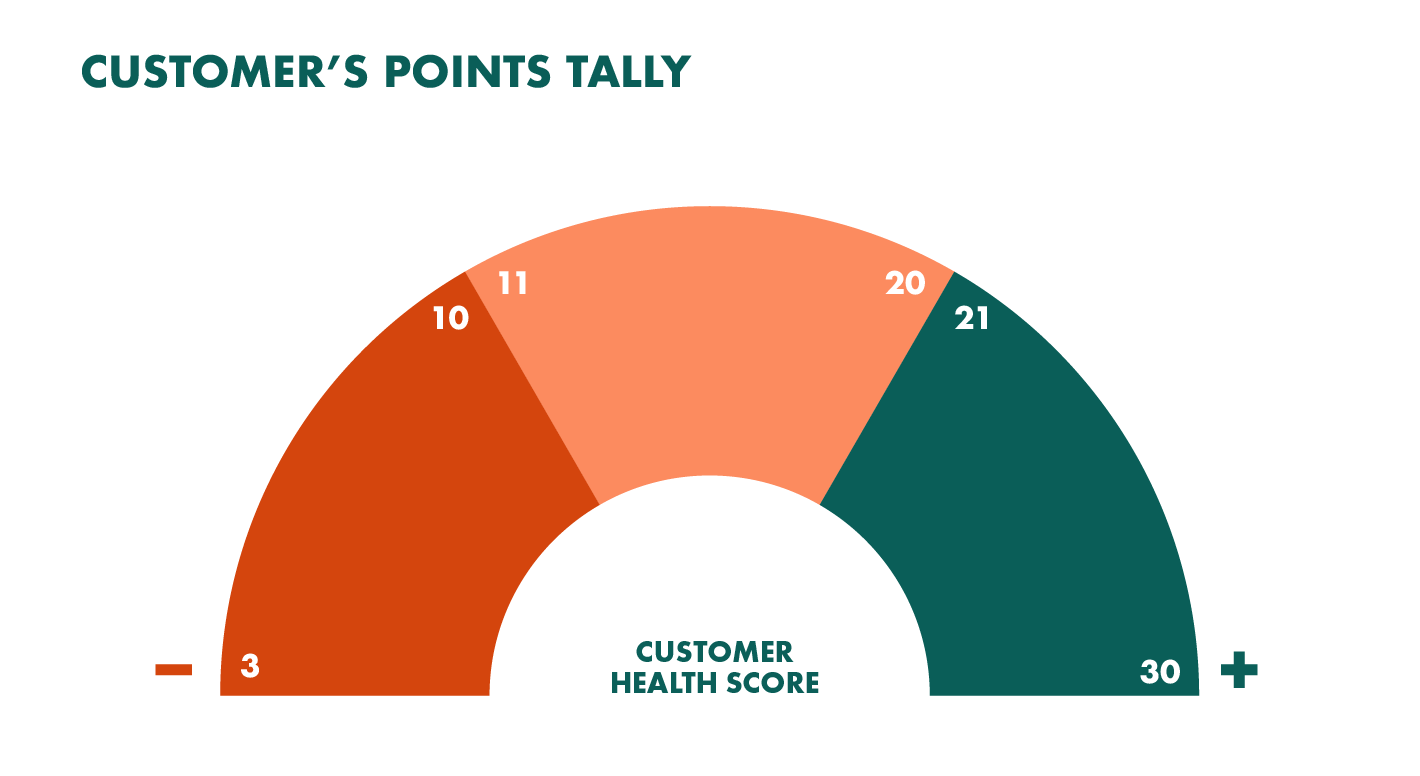

Whether you express it as a percentage, a RAG (Red, Amber, Green) status, or even as a score out of 10, the key thing to note is that a CHS is derived from a combination of your own series of measures that determine what makes your customers successful with your product.

For example, one way to measure CHS is to include the number of logins, support requests or late invoice notices.

Using the table below, a 10 indicates a “perfect” customer whereas a 1 indicates an “at-risk” customer.

![]()

(The most active customers would score higher than 25).

Once you calculate the score, you can then measure their overall health.

In this case, the customer health score report would look like this:

Using a “report card” allows everyone in the organization to easily identify high value customers and customers that are likely to churn. It also provides an opportunity for sales development and/ or customer experience teams to reach out and discuss expansion strategies with your VIP customers (those that score between 25-30).

2. Customer Lifetime Value

How much is a new customer worth to your business?

I don’t mean how much do they spend, but rather – what is their overall value throughout their entire customer journey?

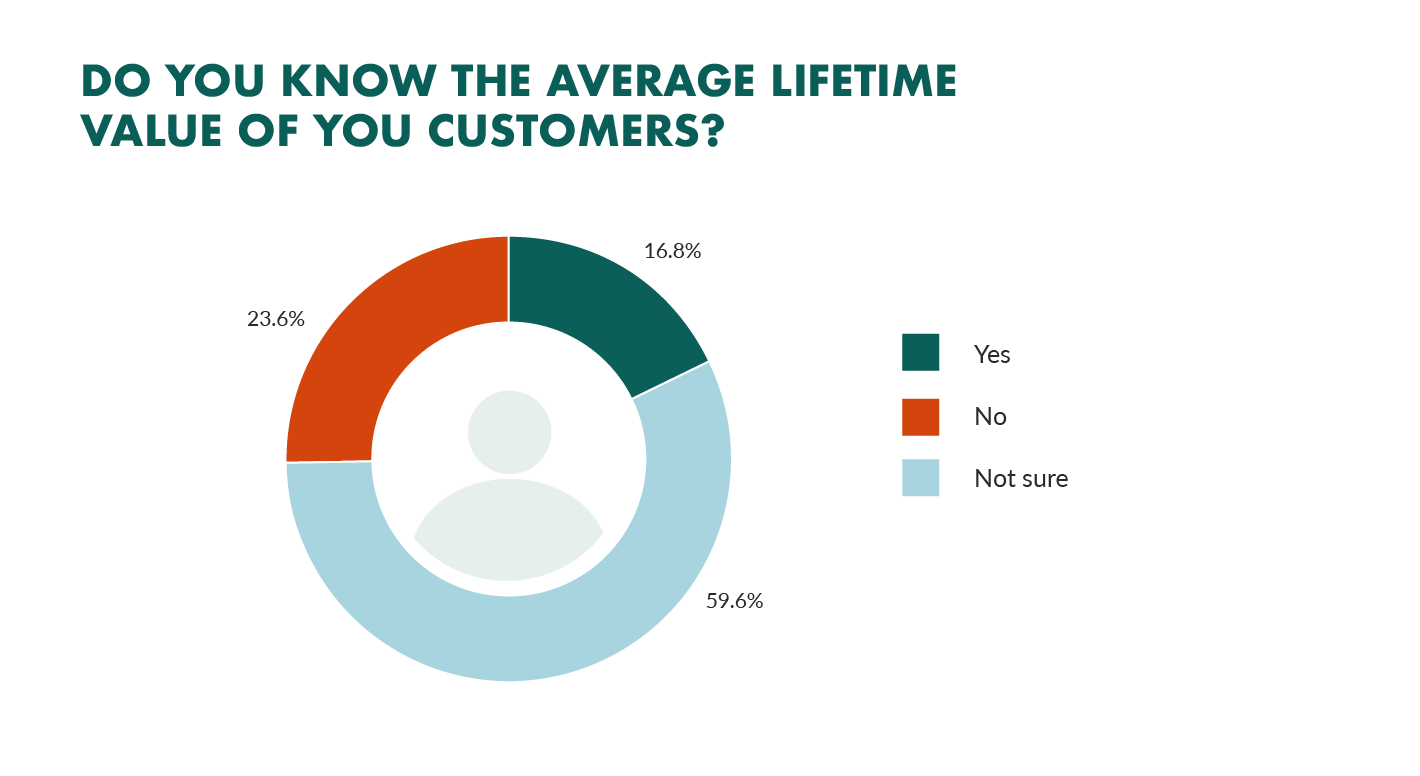

If you’re not sure, don’t worry. Most companies don’t know this either.

It’s known as Customer Lifetime Value, but it’s also known as Lifetime Value (LTV) and Average Lifetime Value (ALV). Either way, the principal is the same and it’s about understanding how much a customer will spend with your business for as long as they do business with you.

Did that help? No? That’s OK. Only 16% of companies have calculated the Average Lifetime Value of their customers.

Whether you call it CLV, LTV, or ALV – this key metric helps you uncover the value of your customers now and new customers you acquire in the future.

(It’s also a really great number to use in your marketing as it helps understand how much you can spend and still make a profit).

Given that so few companies know the CLV, here’s how you can calculate it.

Take the annual revenue you earn from a customer and multiply that by the length of time they are in business with you. Then, deduct the initial cost of acquiring them. Now you have your CLV.

For example, if a customer spends $1,000 annually, and the average "lifetime" of a customer is 10 years, then you multiply annual spend ($1,000) by 10 years ($10,000).

Now, subtract the cost of acquisition (in this case, we'll estimate $1,000), and the CLV is $9,000.

It’s surprising that CLV isn’t used by more companies as this one metric is the basis for understanding:

- What is the overall value of a new customer?

- Are the customers that you’re attracting profitable?

- What are your best and most valuable customers buying?

- How much time, effort and resources can you afford to spend on retention?

- Can you increase your customer acquisition costs and still make money in the long term?

Clearly, measuring CLV can help you identify a number of opportunities for your business.

Most importantly is how it can positively impact your relationships.

Said another way, the more you invest in your customers, the more they will spend with you – thus increasing their lifetime value.

3. Net Promoter Score

Happy customers are the best kind of customers.

Of course, being happy means, they’ll spend more. And being happy means they’re less likely to switch to a competitor.

But the biggest benefit to having a happy customer base is that they become an extension of your marketing team!

Happy customers create unparalleled growth opportunities for your business through word-of-mouth promotion and direct referrals.

But how do you know which customers are the happiest?

Well, you can ask them, manually, one by one. But that’ll take forever!

So, here’s a faster way to achieve it.

Introducing Net Promoter Score (NPS) – a way to measure customer loyalty and advocacy.

Now, you might think “Well, that’s obvious. Of course, I know NPS. Everyone uses it”.

If you do use NPS, fan-tastic!

But our research found that a staggering 71% of companies have never used it!

There are a number of tools designed to help you collect NPS scores from your customers at scale, but at its essence it’s a very simple score to measure and calculate.

It starts by asking your customers the following question:

“On a scale of 0 to 10 how likely are you to recommend our product?”

The scores your customers give indicate their stance as follows:

- Anyone who scores 0-6 are known as Detractors

- Anyone who scores 7 or 8 are known as Neutrals

- Anyone who scores 9 or 10 are known as Promoters

Running a survey to your customers like this has three distinct benefits.

The first is that it’s completely automated (good news, right?).

The second is that you can use NPS to track your company’s overall position in the market and progress against commercial initiatives.

Calculating the score is fairly straightforward, all you need to do is subtract the percentage total of Detractors from the percentage total of Promoters – you don’t need to worry about Neutrals at all.

So, if you have a survey with 100 responses, 30 are Promoters, 60 are Neutrals, and 10 are Detractors, you’d calculate your NPS score like this:

Scores range from -100 to +100. A good NPS score is anything above zero. i.e. you have more Promoters than you do Detractors. To give you an idea: Apple has a score of +47, while Tesla has an astonishing +96!

Finally, NPS allows you to identify your biggest fans (aka advocates) – customers who scored 9 or 10, as well as customers who are seriously unhappy and at risk of leaving or sharing negative sentiments with others (those who scored between 0 and 6).

Reaching out to both of those groups can increase their happiness levels.

3 ways to understand your customers

Understanding the customer is a top priority for the fastest growing SaaS companies.

If you want to transform your business, your entire organization has to take a more hands-on approach to understanding your customers – i.e. by measuring their behavior and performance.

And there are 3 specific metrics that stand out by helping you to get a good overview of your business both in terms of current performance and future growth potential. Let’s recap:

- Customer Health Score – this is a good indicator of how likely your customers are to stick with you both now and in the long term.

- Customer Lifetime Value – this is a great way to understand how much each customer is making you throughout their time with you. It also helps to identify growth potential.

- Net Promoter Score – the best form of marketing is word-of-mouth, and NPS is a great way of seeing how many of your customers would be likely to refer you to others.

Start measuring these 3 metrics, double down on your ability to understand the customer and invest in their growth. Because in 2021, that is the only path to success!

If you want more content like this - content that is only shared with Thrive subscribers, then sign up to Thrive below. Once a week, we'll share stories on business growth, professional relationships and personal success.